Marel is a leading global provider of advanced food processing equipment, systems, software and services.

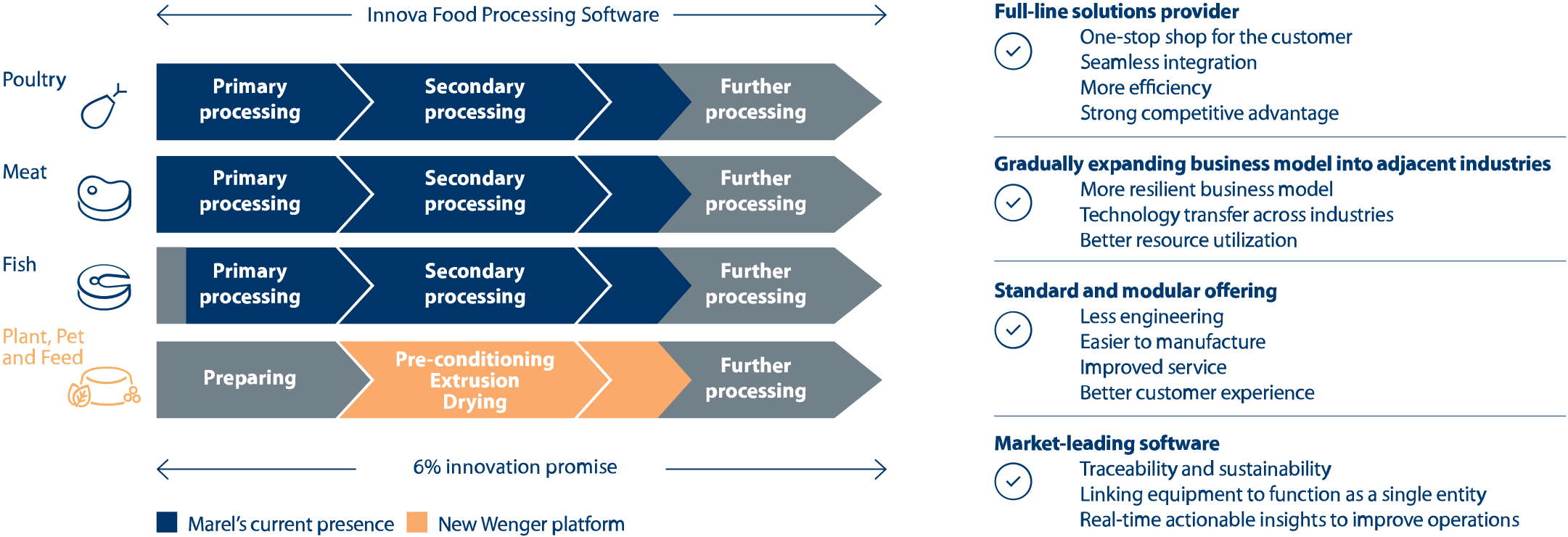

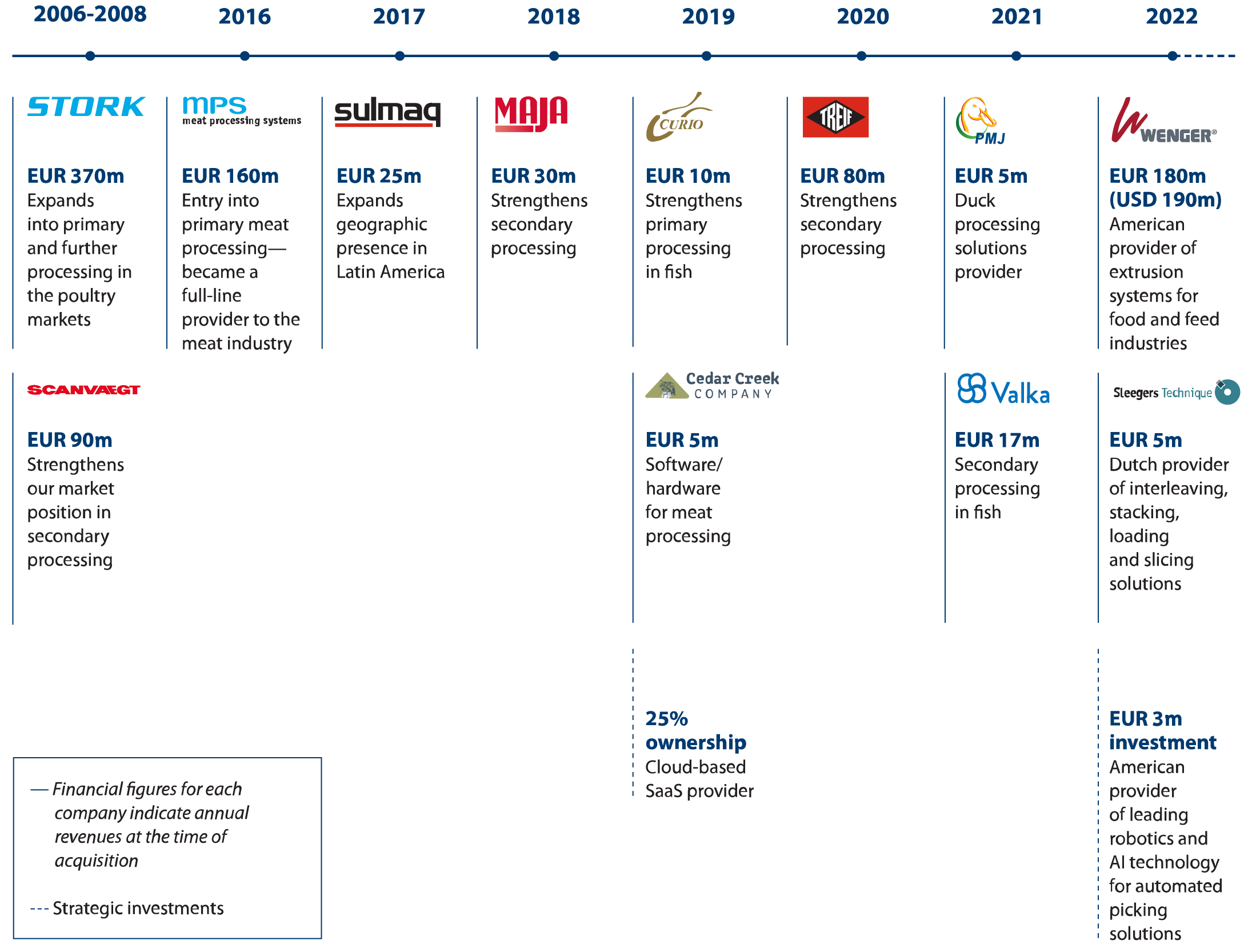

Marel's strategic objective is to be a full-line provider across our four key business segments of Poultry, Meat and Fish, in addition to the newly added segment of Plant, Pet and Feed. Our focus is to put our advanced, automated systems and solutions to work at every step of the production process and to cover the relevant geographical areas in our industries. Strong organic growth and strategic acquisitions have helped make Marel a leader in its field.

Our product line includes standalone equipment, individual systems and full production lines, all controlled and integrated with Innova, our overarching software solution. This offers our customers process control, real-time traceability and monitoring of throughput and yield that is hard to replicate.