Marel has successfully closed the USD 540 million acquisition of Wenger Manufacturing LLC, a global leader in processing solutions for the high growth markets of pet food, plant-based proteins, and aqua feed. The agreement to acquire Wenger, as announced on 27 April 2022, was subject to customary closing conditions which have been fully satisfied as of 9 June, such as anti-trust and approval from Wenger’s shareholders.

Transaction highlights

- Wenger to form a new business segment and fourth pillar of the business model in addition to poultry, meat, and fish, and part of segment reporting as of Q3 2022 financial results.

- The acquisition is expected to be margin and earnings enhancing, pro-forma the Wenger business is around 10% of Marel’s total revenues and 12% of combined EBITDA.

- With over 500 employees located in close vicinity to Marel in Kansas in the US, Valinhos in Brazil, and Kolding in Denmark, Wenger’s revenues in 2022 are expected to be USD 190 million, EBITDA to be USD 32-35 million, and their EBIT margin has been between 14-15% in recent years.

- Total investment for the acquisition is USD 540 million and the transaction multiple corresponds to 14x EV/EBITDA adjusted for expected tax benefits of USD 60-70 million.

- Of the total investment, USD 530 million was the purchase price on a cash and debt free basis, paid with USD 526 million in cash and existing credit facilities, and 960 thousand Marel shares. The remaining USD 10 million is a combination of a contribution to a not-for-profit private foundation, to continue the legacy of Wenger and its meaningful impact on the community, as well as Marel shares for Wenger employees.

- The acquisition will be financed through Marel’s strong balance sheet and existing credit facilities.

A platform investment forming the fourth business segment

This new platform investment is an important market entry into new and attractive growth markets where Wenger’s industry-leading extrusion and dryer technologies forms the anchor point in a new segment in Marel’s business model. Wenger shares Marel’s passion for innovation and commitment to best-in-class products, backed by an experienced team, and long-standing partnerships with customers, ranging from blue-chip pet food processors to startup companies in plant-based proteins. This has resulted in Wenger’s healthy profitability with an EBIT margin of 14-15%, strong cash flow and solid return on invested capital.

On a pro-forma basis, this new business segment accounts for around 10% of Marel’s total revenues and 12% of combined EBITDA. Over 60% of Wenger’s revenues derive from pet food where the company has a global leading position within their focus market segments. They have a strong foothold in the North American market and over 40% of revenues come from services. Wenger’s revenues have organically grown approximately 5% in 2017-2021, and revenues in 2022 are expected to be USD 190 million, EBITDA to be USD 32-35 million.

The new segment will be run on a standalone basis, reporting to Arni Sigurdsson, Chief Strategy Officer and EVP of Strategic Business Units. As of Q3 2022, this new platform will become part of Marel’s segment reporting alongside the poultry, meat and fish business segments.

Sizeable and attractive growth markets

There are immediate opportunities for growth and value creation by leveraging Marel’s global reach and digital platforms in Wenger’s sizable and attractive markets. The global petfood and aqua feed markets are estimated at over EUR 100 billion and EUR 50 billion respectively and growing at 5-6% annually. The plant-based protein market is currently around EUR 7 billion and expected to grow 15-20% annually.

The addressable market for Marel and Wenger in solutions and services within pet food, plant-based proteins, and aqua feed is estimated to be around EUR 2 billion with expected annual growth of 4-6%, in line with Marel’s long-term market growth expectations.

Aim to strengthen the value proposition with complementary offering

Wenger is a true leader in its field of providing solutions and services to the pet food and aqua feed industries and has in recent years made its mark on the fast-growing plant-based protein consumer market with best-in-class solutions positioned right at the center point of the value chain.

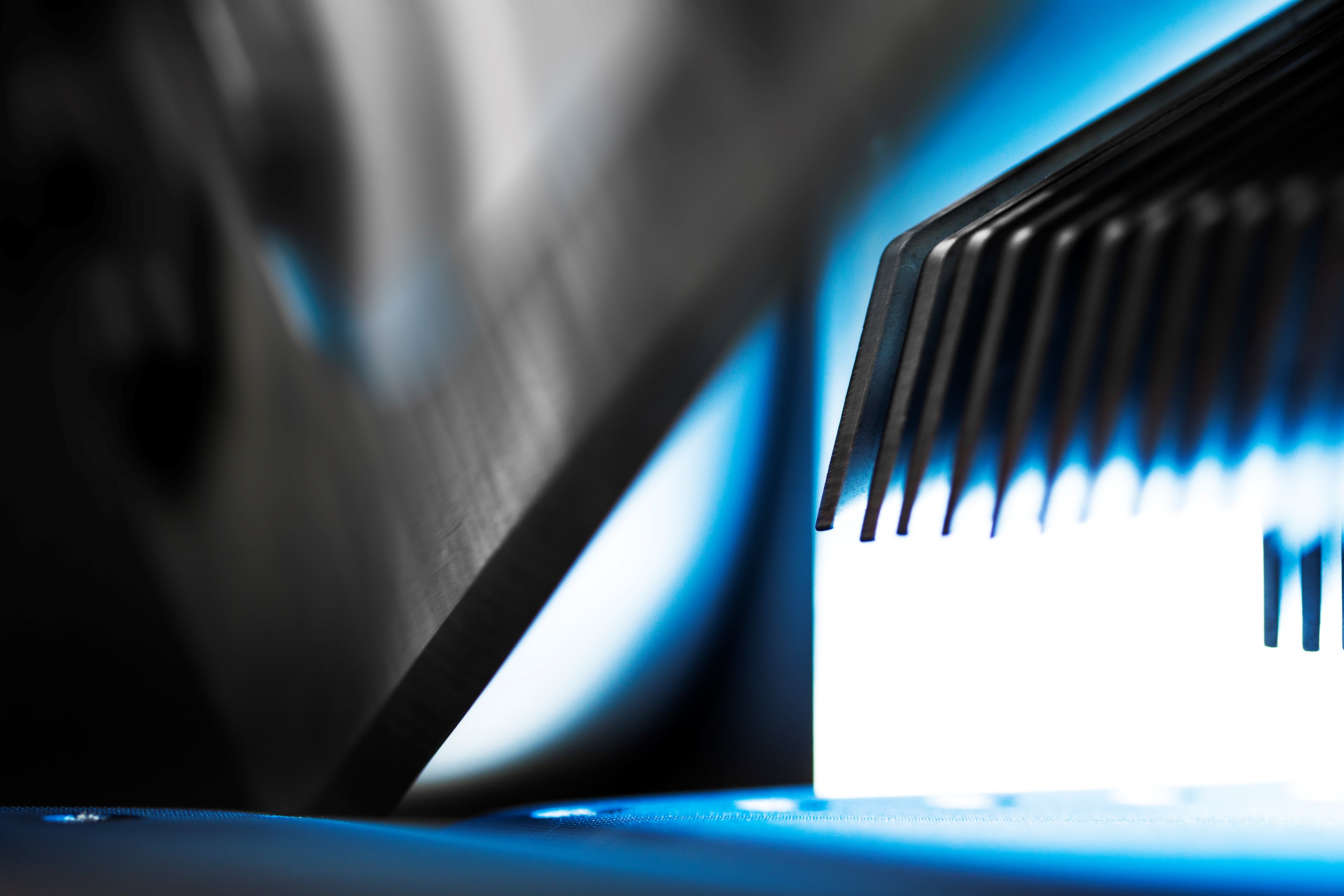

The two companies have complementary technologies and product portfolios that will strengthen the value proposition with line solutions for processors of plant-based protein. Wenger’s industry-leading extrusion and dryer technologies are a strong anchor point in the value chain that defines the texture and quality of the end product. Marel’s highly complementary product portfolio will then add technologies such as weighing, sorting, inspection, low-pressure forming and thermal treatment, all aimed at ensuring high-nutrition products that are processed in a safe and sustainable way.

Investing in further growth

Marel is committed to invest in the combined business to drive commercial synergies and accelerate growth. Planned initiatives include expanding manufacturing capacity to respond to high demand in Wenger’s core markets, in particular pet food. Marel’s global reach and digital platform will support a more proactive aftermarket approach to better service customers around the world and utilize customer relationships to cross sell the combined portfolio.

See also

| Marel's business model |

| Marel 2017-2026 growth strategy |

| Marel to acquire Wenger announcement |

| View investor presentation (PDF) |

| Watch investor meeting |

For further information, please contact:

Marel Investor Relations

Tinna Molphy

IR@marel.com and tel. +354 563 8001

Media Relations

FTI Consulting - Alex Le May / Matthew O’Keeffe

marel@fticonsulting.com and tel. +4420 3727 1340

About Wenger

Before joining Marel, Wenger was a family-owned business with over 500 employees located in Kansas in the US, Valinhos in Brazil, Kolding in Denmark. Wenger is the premier global leader in extrusion systems for producing pet food, aqua feed, and plant-based protein and revenues in 2022 are expected to be around USD 190 million and EBITDA of USD 32-35 million. Wenger has an excellent market reputation for high-quality products and process know-how, and the company has a diversified and loyal customer base, ranging from global blue-chip processors to smaller specialized players. Wenger was founded in 1935 by Joe and Lou Wenger with the purpose of manufacturing affordable cattle feed. It has since made a strong impact in the food and feed industries by commercializing the cooking extruder for both human and pet food production.