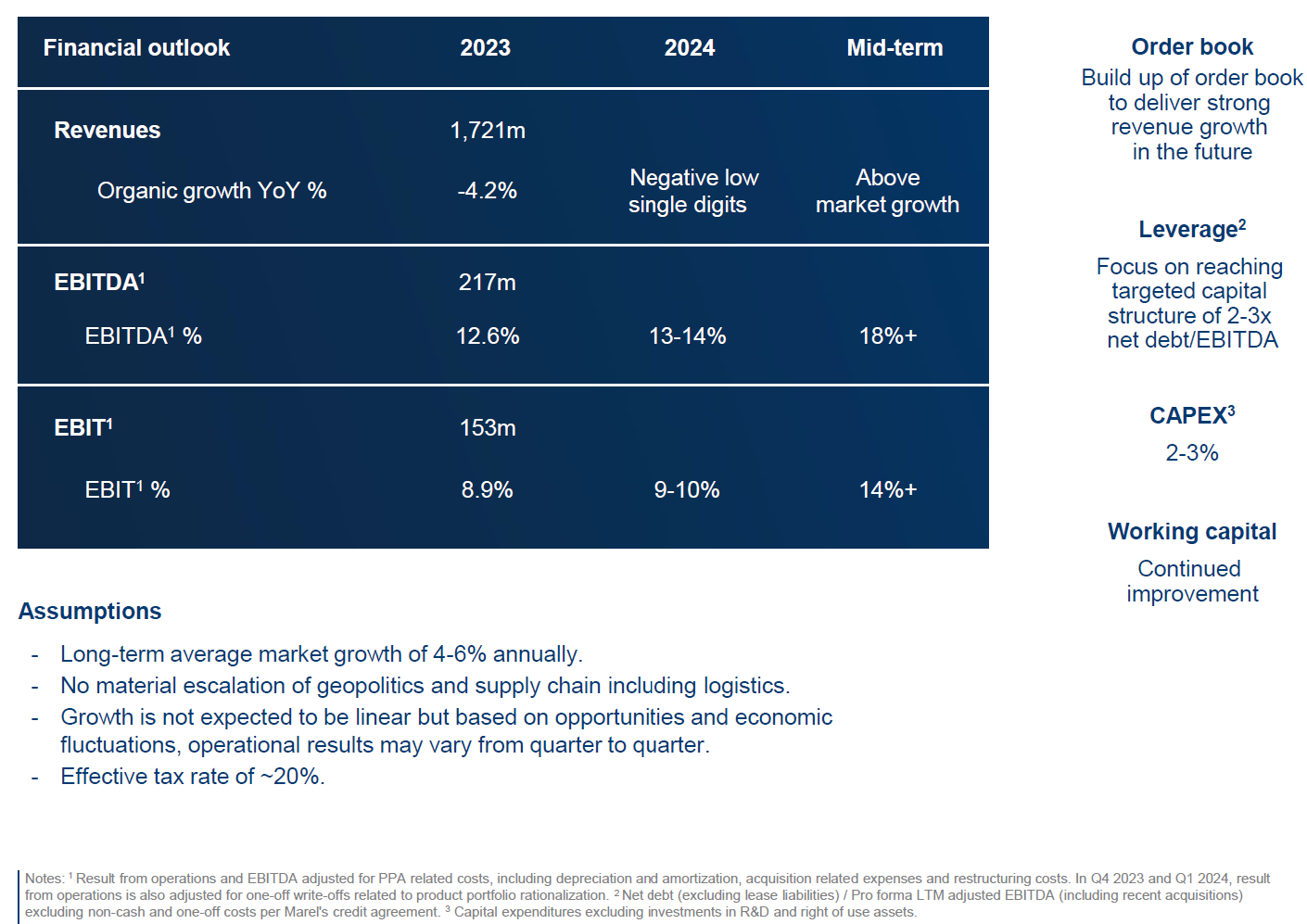

As announced in the Q4 2023 results, management presented an updated outlook for 2024 and the medium term based on the challenging macro environment, the business cycle within the food industry, and uncertainty on timing of recovery. Headwinds are expected to moderate in the coming quarters, supported by positive signs in the market.

Outlook

Outlook for 2024 and medium term

Outlook for the mid-term is unchanged. Marel operates in attractive growth markets with expected long-term average market growth of 4-6% annually, supported by favorable secular trends, focused on automation, robotics technology and digital solutions to optimize processing and address customers’ challenges of better utilization of raw materials, labor scarcity, high input costs and rising number of end products.

There is continued short-term uncertainty due to rising geopolitical tension, persistent inflation, and the high-interest rate environment. This is evidenced by the lower-than-expected projects orders received in the first half of the year. The challenging market conditions have resulted in a decline of the order book in 2023 and 1H24.

Headwinds expected to moderate in coming quarters, supported by positive signs in the market. Orders received are expected to build up in 2H24, market outlook is improving and there are positive signs in customer sentiment, especially for poultry. To deliver revenue growth and improved operational performancein the future, build up of the order book is needed.

In the Q2 2024 results published on 24 July, the outlook for the full-year 2024 was revised to 9-10% EBIT and 13-14% EBITDA and revenue decline of low single digits

Other considerations include the continued improvement of working capital, full focus on cash and EBITDA generation to reach targeted capital structure of 2-3x net debt/EBITDA, and CAPEX3 to be at normalized levels of 2-3% after a period of elevated investments.

Assumptions include long-term average market growth of 4-6% annually, no material escalation of geopolitics or disruption in supply chain and logistics, and effective tax rate of ~20%. Growth is not expected to be linear but based on opportunities and economic fluctuations, operational results may vary from quarter to quarter.

Notes: 1 Result from operations and EBITDA adjusted for PPA related costs, including depreciation and amortization, acquisition related expenses and restructuring costs. In Q4 2023 and Q1 2024, result from operations is also adjusted for one-off write-offs related to product portfolio rationalization. 2 Net debt (excluding lease liabilities) / Pro forma LTM adjusted EBITDA (including recent acquisitions) excluding non-cash and one-off costs per Marel's credit agreement. 3 Capital expenditures excluding investments in R&D and right of use assets.

FY24 and mid-term outlook

You may also be interested in